At Least Someone’s Interested in Controlling Inflation

Brazil’s Central Bank raises its interest rate 0.25% to 12% out of fear of losing control of inflation. And the usual suspects cry foul.

Brazil’s Central Bank raises its interest rate 0.25% to 12% out of fear of losing control of inflation. And the usual suspects cry foul.

Standard & Poor’s just shot a big gun across the bow of our ship of state, warning of

a “material risk” the nation’s leaders will fail to deal with rising budget deficits and debt.

At least one player in the government bond market agrees:

“It’s truly a shot across the bow and a message to Washington, which has been clowning around on this and playing politics when they should toss ideology aside and focus on achievement,” said David Ader, head of government bond strategy at CRT Capital Group LLC in Stamford, Connecticut. “The bond market is still trying to find out what to make of it. People don’t know what to do. If you sell Treasuries, what do you go in to? No one knows.”

So what’s Treasury’s response?

Treasury Assistant Secretary Mary Miller said today that S&P’s outlook on the U.S. credit rating “underestimates” U.S. leadership.

“We believe S&P’s negative outlook underestimates the ability of America’s leaders to come together to address the difficult fiscal challenges facing the nation,” Miller [NKA Baghdad Bobbette] said in a statement. (emphasis supplied)

Our debt may becoming more expensive, but this response is priceless.

UPDATE: As Barry Ritholtz’s post at The Big Picture reminded me, the S&P is very late with its take on this party, a party Bill Gross walked out of over a month ago.

Barack Obama is back, and the press–in the person of Jonathan Alter–is carrying his water, again. In a column titled Republican Horror Movie Sequel Hits Theaters Alter breathlessly warns Republicans to

Be afraid. Be very afraid.

And why? Because of that speech BO gave last this week at George Washington University. You know, the one universally panned as not serious, awful, presidential politicking at its worst? Yeah, that one.

So why is Alter experiencing that special tingle? Well, for one, BO’ s a great story teller. I agree, but then I’m thinking of story in the sense that the man says whatever is to hand, whether it’s true or not. When his lips move, well, my antennae go up. I don’t think that’s what Alter meant.

The other think that’s ginned up the good columnist is that idea that

Most important, the president stressed the fundamental American values of fairness and compassion.

In other words, we’re back to Joe the Plumber talk–redistribution.

A highlight of Alter’s piece for me was his admission that Democrats are given to demagoguery. In taking his swipes at Rep. Paul Ryan’s budget plan, Alter writes,

Older, independent voters that Republicans won in 2010 will despise the Ryan plan once it filters down to them. A Democratic war cry of “They’re killing Medicare!” isn’t demagoguery this time. It’s true.

No, in fact it’s not true and Democratic talk like this continues to be demagoguery, especially given the fact that they refuse to offer a plan of their own with any specifics in it. Exactly how would they deal with Medicaid and Medicare, plans that Alter in one breathe says are “wildly popular” yet “must be reformed”?

As he admits, we’ll get no help from the Annointed One.

The president offered few specifics about how to save $4 trillion over 12 years beyond letting the tax cuts for wealthy expire in late 2012. That won’t be enough. But teeing up tax cuts for the rich as a campaign issue will clearly help the Democrats, as it did in 2008.

Yeah, that should scare Republicans. Drag out the hoary ghost of campaigns past, the “tax cuts for the wealthy” meme. If this is BO’s game, it brings to mind this game:

He’ll not win this time, not throwing like that. I’m not sure our fawning press will manage to carry that ball over the plate.

Walter Russell Mead writes in The American Interest that the relationship between the U.S. and Brazil have changed, for the better.

The new US-Brazilian relationship does not quite live up to [the US-India relationship], but the ramifications of the changing relations between the two dominant powers in the western hemisphere will nevertheless make waves. It is likely in the 21st century that Brazil will join the group of countries Americans listen to and rely on the most, and the countries whose interests Americans take the greatest care to address.

With the fall of the Soviety Union, Mead argues, the U.S. no longer has a reason to meddle in South American affairs. And for Brazil?

On the Brazilian side, something even more important has happened: Brazil has begun to believe that the world economic system might just work to Brazil’s advantage. . . . Brazil’s success in a range of industries, like aviation, and the success of Brazilian companies that have become fully-fledged multinational players (a Brazilian firm now owns Anheuser-Busch, for example) make more and more Brazilians feel that on a level playing field, Brazil can win.

That’s certainly the feeling I get as I read the Brazilian press. That was the feeling I had yesterday when I spoke to Roberto Garibe, Special Advisor of the Executive Office of the Presidency of Brazil. I was calling to interview him for an article I’m writing about foreign investment in Brazil in preparation for the upcoming World Cup and Olympics. I asked him about the Reuter’s story I posted about the other day, the one critical about PAC, Brazil’s accelerated growth program. He acknowledge that they might not meet the people’s expectations, but thought those expectations might not have been realistic to begin with. That said, he reminded me, PAC is much more than the Word Cup and the Olympics. Long after those sporting events have turned off the lights, Brazil would be busy improving its infrastructure and the standard of living of its people. He sounded like someone intent on making sure that would happen. And if my experience with him is indicative of the work ethic of the people working with him, Brazil will meet its development goals.

According to O Globo, Brazil’s Civil Aviation Secretary, Walter Bittencourt, guarantees that his people are working so that the nation’s airports can handle the influx of people attending the World Cup in 2014.

We’re discussing the exact strategies we can use to accelerate the work on the airports . . .

Of course, promising that you’re working hard is different than promising that the airports will be ready. I’m hoping they will be.

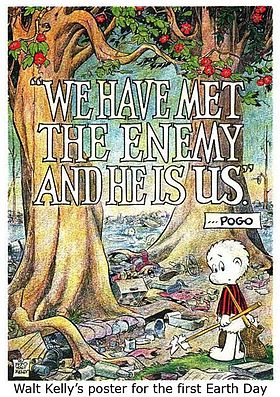

Or as Pogo might say,

Today in The Washington Post,

Robert Samuelson writes,

We in America have [elected a] suicidal [president]; the threatened federal shutdown and stubborn budget deficits are but symptoms. By suicidal, I mean that [president] has promised more than [he] can realistically deliver and, as a result, repeatedly disappoints by providing less than people expect or jeopardizing what they already have.

Okay, so I changed a few things, the word president for the word government, for example. Or the word elected for the word created. But Samuelson could have written what I’ve posted and still have been right. Right?

Anyway, he actually says that our suicidal government is so in part because

[We] depend on it for so much that any effort to change the status arouses a firestorm of opposition that virtually ensures defeat.

Why is that? Surprise of surprises, because

The Census Bureau reports that in 2009 almost half (46.2 percent) of the 300 million Americans received at least one federal benefit: 46.5 million, Social Security; 42.6 million, Medicare; 42.4 million, Medicaid; 36.1 million, food stamps; 3.2 million, veterans’ benefits; 12.4 million, housing subsidies. The census list doesn’t include tax breaks. Counting those, perhaps three-quarters or more of Americans receive some sizable government benefit. For example, about 22 percent of taxpayers benefit from the home mortgage interest deduction and 43 percent from the preferential treatment of employer-provided health insurance, says the nonpartisan Tax Policy Center.

Kind of makes you lose hope that things are going to change.

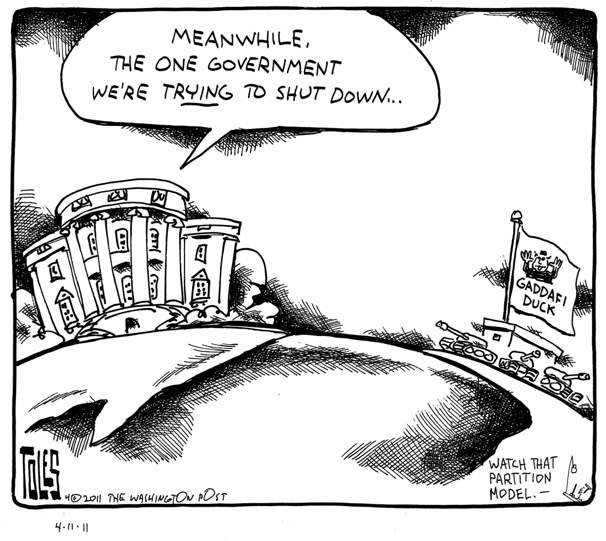

Over at The Washington Post, Ted Toles nails it.

Higher Education Bubble Poised to Burst.

The Impending Collapse of the Gold Bubble Part 2

Is this a 2011 Internet tech bubble?

How to trade the popping alternative energy bubble

Is for-profit education a bubble, as Posner and Eisman claim?

Are College Loans the Next Bubble?

Shiller Speaks: Here Comes a Commodity Bubble

JP Morgan Analyst Predicts Bubble Burst For Apple iPad 2 Rivals

Biz Break: Social networking bubble? A warning from Warren Buffett

Is the Porn Bubble About to Pop?

When Will the Next Bubble Burst?

A couple of these links go back as far as March 2010. Most are recent headlines. Can you short the shorts?

Gary Becker, George Schultz, and John Taylor have a plan to bust the budget. It’s worth reading. To me the most obvious gem in the plan, and the one most sorely missing in all the talk in Washington right now is this:

Assurance that the current tax system will remain in place—pending genuine reform in corporate and personal income taxes—will be an immediate stimulus.

Congress and the President (any Congress and any President) have used the tax code to implement policy choices. It’s time to leave the rules be, so that business can plan, something they are loathe to do when there’s no promise that the rules won’t change next week.

I’ve been listening to Michael Lewis’s book, The Big Short, the first book I’ve read on the financial crisis of 2007-2008 (and who’s kidding whom, the crisis we’re still in). The cast of characters is beyond interesting: Steve Eisman, Greg Lippman, Dr. Michael Burry, and many others.

I went online today in search of some information on the three people I just mentioned, found a little at Wikipedia, and then found this, which lead to this, which lead me to a copy machine.

Among other pursuits, I teach Honors Thesis Writing at BYU. The projects my students are involved in are quite impressive. Can’t wait to read Barnett-Hart’s thesis to see how it stacks up.

Panorama Theme by ![]() Themocracy

Themocracy