This morning, as I drove to meet my brother and sister-in-law for breakfast, NPR’s Morning Edition treated me to a teaser lead-in to a story that taxpayers were soon going to get back all the money the government had invested in AIG during the bailout. The actual story (which I cannot find online) confirmed the headline, though it sort of hedged with words like “depending on stock performance” and such.

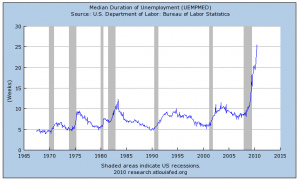

I own shares in AIG. Prior to the bailout, I owned 20 Xs more shares–but that’s another story. Point is, I watch the stock and news about the stock. And I watched recently as the share price climbed above $52 a share on January 7 (I bought those shares at the reverse split-adjusted price of $43.60 on 9/18/08). Since that high, the share price has fallen precipitously to just over $42.00 as I write, almost a 20% decline in two weeks. In other words, I’m worse off than when I bought the shares over three years ago. So exactly how are the taxpayers getting paid back–soon–if the market value of AIG has decreased? I understand that the government and/or AIG may sell off operating companies and repay the debt from the proceeds. Do the value of the parts exceed the value of the whole?

Or is this more Prava-like reporting of the sort that the Seattle Times debunked this morning? Referring to the White House’s recent announcement of $19 billion in new Boeing jet orders, an announcement timed to coincide with the visit of Chinese President Hu Jintao, reporter Dominic Gates writes,

The deal President Hu signed does not include any new jet orders.

Delivering the formal approval during Hu’s visit is designed to make the Chinese government appear responsive to U.S. concerns about the balance of trade.

However, all of the airplanes in the sale were announced and booked by Boeing as firm orders over the past four years. Chinese airlines had already paid nonrefundable deposits and signed contracts for the jets, most of them as far back as 2007.

Gates continues,

The White House announcement said the total value of the orders was $19 billion.

But that’s the list price, which airline customers never pay.

Based on market data from aircraft-valuation consultancy Avitas, the actual price for those 200 planes is about $11 billion.

To be fair, Gates points out that Boeing says that the Chinese government’s approval is important, but . . .

Summing up the deal, Gates closes with,

Our verdict: The Chinese orders are real and will help keep Boeing workers busy here through 2013. Still, the White House announcement, while technically true, left a completely false impression.

The orders weren’t new. They weren’t really worth $19 billion. And Boeing isn’t soaring ahead of its big global rival with this deal.

An accurate headline for the news might have said: Hu finally signs off on old orders for U.S. jets, but Boeing still lags Airbus in China.

Likewise, an accurate lead-in for the AIG story on NPR might have said: Taxpayers will recoup their investment in AIG if the stars align and the stock price ever gets high enough, but that’s far off in the future.

Update: I found a Reuters story that I think the NPR story was based on. The three nut paragraphs:

In its third report on the bailout of AIG, the GAO said U.S. taxpayers’ risk exposure to the insurer increasingly is expected to be tied to the success of AIG and its value as seen by investors in the company’s common stock.

“The government’s ability to fully recoup the federal assistance will be determined by the long-term health of AIG,” the report said.

A Treasury official said taxpayers were in a strong position to recover “every dollar put into AIG.” (emphasis supplied)

I’m virtually certain the two quotes appeared in the NPR story. The second quote resembles the NPR headline. Alert readers will notice that the first quote basically takes all the zing out of the second, and thus the headline of the NPR story.