Pete, Don’t Let the Door Hit You in the Butt

I have never cared for Congressman Pete Stark (Dem.-Calif.). He was a demagogue of the worst sort, illustrated here by his parting comments on Morning Edition today. (I can give you more evidence if you want, but this will do.)

And what will Stark miss most when he leaves Congress?

“It’s one of the areas in which you get up … in the morning and look at the mirror … and say, ‘Hey, I’m going to do something today that’s going to make life better for somebody.’ And that’s pretty neat,” Stark says. “When I was a banker I’d get up and say, ‘Whose car am I going to repossess?’ or ‘Whose house am I going to foreclose?’ and that didn’t start you out on a very nice approach for the rest of the day.”

Because that’s all bankers do, you know, repossess and foreclose. Nothing else. And no mention that much of what Stark did to make “life better for somebody” almost certainly made life worse for somebody else.

Given that he (as a former banker, no less) reduces banking to repossession and foreclosure, it’s no surprise that he doesn’t understand the law of unintended consequences. For example, we have a stock market that has climbed to great heights under Mr. Obama–who gets lots of credit for that. But why is the market climbing? Well, it’s due in no small part to the almost-free money policies of the Fed. And who does that hurt, who does that “make life” worse for? Well, among others, people on fixed income, especially retirees who find themselves with nest eggs unable to generate enough interest income to sustain them in their golden years.

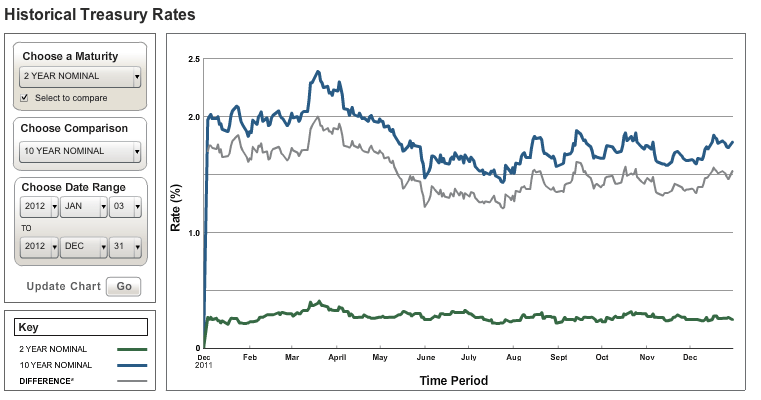

How low are the rates? Here’s a chart from the Treasury showing short-term and long-term rates on Treasuries over the last year. The second chart shows those same rates, starting back in January 2008.

Note the steady decline in rates since 2008, until 10-year rates hover around 1.5% and 1-year rates are around 0.25%–that’s 1/4 of 1%, for the decimally challenged. Now imagine that you’re living on a fixed income at those rates. Yes, Pete, when you help someone to a better life, you often impact the life of another for the worse. How many of those on fixed income have lost their homes or cars to the bank.